Is Your Money In The Bank?

When you deposit your hard-earned money in the bank, you think that it’s nice and safe in the bank vault. But that’s not quite how it works. Your money in the bank isn’t actually yours. It isn’t money and it isn’t even in the bank. The reality is far more complex and, for many, unsettling. Let’s dive into the complexities of what happens to your money in the bank and why it’s crucial to understand the true nature of modern banking. We will also see how Bitcoin is the complete opposite of having money in the bank and why it’s a better option.

Your Money In The Bank Isn’t Yours

When you deposit money in the bank, you are legally signing over ownership to the bank. This means that your money in the bank isn’t really yours anymore. You are essentially giving the bank a certificate of debt, which they promise to pay back to you at some point in the future. This debt is not just a simple promise; it comes with strings attached.

If you want to go into the bank to make a withdrawal, you will be required to answer all sorts of privacy-invasive questions. The bank might even deny you the right to your own money. There are countless stories of people attempting to make even small withdrawals of only a few thousand dollars and the bank denying them. This is true for normal people like you and me, but it’s even worse if you ever come into the crosshairs of any political system. For example, Canadian truckers, journalists, whistleblowers, and activists have faced severe restrictions and outright denial of access to their own funds because the bank didn’t like what users were doing with their own money. The bank has the power to freeze your accounts, impose withdrawal limits, and even report you to authorities if they deem your activities suspicious. This level of control highlights the precarious nature of keeping your money in the bank.

Your Money In The Bank Isn’t Money.

Your money in the bank isn’t money at all and hasn’t been real money for decades. It’s actually a certificate of debt that promises to pay you real money at some point in the future. Your fake money in the bank is actually an IOU issued by the central bank, and gets lent out countless times to other businesses and individuals who want to buy things like homes, start businesses, and overspend with shopping sprees on credit cards. This debt-based system allows banks to create money out of nothing, lending it to individuals and businesses at interest. The original deposit is then multiplied through fractional reserve banking, where banks are only required to hold a fraction of the deposited money in reserve. This means that your money in the bank is used to create more debt, further expanding the money supply and inflating the cost of goods and services.

Your Money In The Bank Isn’t In The Bank.

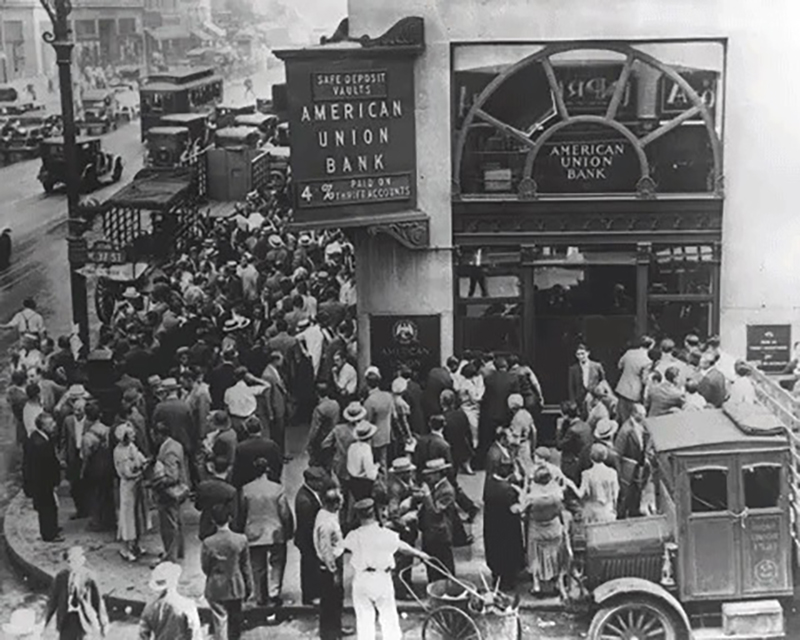

When you deposit money, the bank actually uses it to make loans so that the economy can continue to expand. This means that your money in the bank isn’t physically sitting in a vault waiting for you to withdraw it. Instead, it’s being used to fund mortgages, car loans, student loans, credit card debt, and other financial instruments. The bank creates new money by lending out more than it has in reserves, a practice known as fractional reserve banking. This system allows banks to generate profits through interest payments, but it also creates a fragile financial ecosystem where a run on the bank could lead to a collapse.

The illusion of your money in the bank being safe and secure is just that—an illusion. Banks are subject to risks, including market fluctuations, economic downturns, and regulatory changes. In times of crisis, your money in the bank can be at risk, as seen during the 2008 financial crisis when many banks teetered on the brink of collapse. Governments and central banks had to intervene with bailouts and quantitative easing to prevent a full-blown economic meltdown. This highlights the fragile nature of the banking system and the risks associated with keeping your money in the bank.

The Bitcoin In Your Wallet Is Yours

When you own Bitcoin, it is truly yours. Unlike your money in the bank, Bitcoin is not subject to the control of any central authority. You hold the private keys to your Bitcoin wallet, giving you complete control over your funds. This means that no bank, government, or third party can freeze, seize, or otherwise interfere with your Bitcoin. You have the freedom to use your Bitcoin as you see fit, without the need for permission or approval.

Bitcoin operates on a decentralized network, where transactions are verified and recorded on a public ledger known as the blockchain. This ensures transparency and security, as every transaction is immutable and cannot be altered or deleted. The decentralized nature of Bitcoin makes it resistant to censorship and seizure, providing a level of financial sovereignty that is unmatched by traditional banking systems.

The Bitcoin In your Wallet Is Money

Contrary to what some may tell you, Bitcoin is money. Bitcoin is scarce, durable, portable, acceptable, divisible, and fungible which makes it capable of functioning as a store of value, medium of exchange, and unit of account.

Unlike your money in the bank, which is subject to inflation and devaluation, Bitcoin’s hard-capped supply of 21 million coins makes it the ultimate form of money for long-term savings. This scarcity makes Bitcoin a store of value, similar to gold, and protects it from the erosion of purchasing power that plagues fiat currencies.

Finally, what makes bitcoin money is that it is under your own control. It’s an actual bearer instrument like REAL cash. Instead of putting money into a bank account and being issued an IOU for your money, bitcoin in your own wallet is your own money. It isn’t backed by anything. Bitcoin is the thing. It is the thing that backs like gold or collateral for a loan.

The Bitcoin In Your Wallet Is Actually In Your Wallet

When you control your own bitcoin private keys, you actually own your money. It’s not being lent out at interest by multiple banks using the shady practice known as rehypothecation. As soon as you take custody of your own bitcoin, you are the only one who is in control of your money. It is yours to keep, spend, or invest as you see fit.

The security of your Bitcoin wallet is paramount, as losing your private keys can result in the loss of your funds. However, with proper security measures in place, your Bitcoin can be kept safe and secure in your wallet.

Take Action. Use Bitcoin.

Given the inherent risks and lack of control over your money in the bank, it’s time to consider alternative financial solutions. Bitcoin is that solution. It is the inverse of how banking works.

Your money in the bank isn’t yours, isn’t money, and isn’t in the bank.

Bitcoin, on the other hand, is yours, is the most honest money in history, and is yours as soon as you take custody of it by controlling your private keys.

By adopting Bitcoin, you can take control of your financial future and protect your assets from the risks associated with keeping your money in the bank. Bitcoin represents a paradigm shift in how we think about money and finance, offering a more secure, transparent, and decentralized alternative to traditional banking. It’s time to break free from the shackles of the old financial system and embrace the future of money with Bitcoin.